Yes – you read that right. In the UK, there’s £20 billion in lost pension money. You may be wondering what on earth is a ‘lost pension’? Well, it’s where someone, like you, has saved money into a pension –their employer probably added some cash, too – but they’ve lost touch with the pension provider. So, the money is sitting there, and the pension provider has no way of contacting them as they approach retirement to help them get their hands on their money.

Table of contents

How do you lose a pension?

Losing a pot of money seems an unlikely thing to do, but it’s easier and more common than you might think:

- People move home an average of 8 times in their life but only 1 in 25 tell their pension provider they’ve moved.

- It’s likely you’ll have more than one job in your life; in fact, the average number of jobs in a working life is 11. In 2012, some legislation was introduced that meant employers had to start providing a pension for employees. Each job you have is likely to come with a pension – and the more pensions you have, the easier it’ll be to forget about one.

- Between 1978 and 2002, people, or their employers, could choose to opt out of the additional state pension (also known as S2P or SERPS: the State Earnings-Related Pension Scheme) and put those payments into a pension scheme. So, some people may have taken this option and forgotten about the pot that it built.

Plus, with old-fashioned letters often replaced with emails and online accounts, it’s easy to forget what you’ve been signed up for.

How to find a lost pension: practical tips and know how

- Check your own paperwork

- Safely filed letters or emails – you would have received something when you joined your employer or were provided with a workplace pension. You also might have received annual communications with details of your pension.

- Payslips and contracts – if you’ve kept these, they should have details of either deductions from your salary to your pension, or any contractual adjustment made to your pay that was then paid into your pension.

- HMRC confirmations – to check if you ever opted out of the additional state pension. You can contact HMRC with your National Insurance number to check this.

These should give you some useful starting points.

- Check with your employer

If it’s a workplace pension you’re tracking down, your employer, or previous employer, will know which pension provider they used. You can get in touch with them and ask for details.

If that’s not possible, or even too awkward, here’s what we suggest:

- Try to remember dates

It doesn’t happen anymore, but it used to be quite normal for pension contributions to be refunded when you left an employer if you’d only been there for a little while. So, if you think you may have a pension from an old job, here are some key dates to look at so you’re not searching for a lost pension that has already been refunded:

- 1975 – if you left a job before 1975, it’s most likely that you had refund and haven’t lost a pension. If you worked for the same employer for more than 15 years, it’s worth checking to make sure.

- Between 1975 and 1988 – if you were under 26, or had less than 5 years’ service between these dates, you most likely had a refund.

- 1988 – if you worked for an employer for over 2 years since 1988, you could have a lost pension.

There is no harm in checking if you’re unsure.

- Gather everything you need to make the call

When you contact an employer or a pension provider, you’ll need to have some information to hand:

- Your National Insurance number

- Your full name (and any previous names)

- Your date of birth

- Your address (and any address you may have lived at before you lost the pension pot)

- The name and address of the company you worked for

- The dates you were employed

- Use the Government’s pension tracing service

If you’re struggling with finding details of pension providers or past employers (the company may not even exist anymore) then you can use the Pension Tracing Service.

It’s provided by the Department for Work and Pensions and the best bit is, it’s free! It searches over 200,000 pension schemes to try and find your lost pensions.

Find out more about the Government’s Pension Tracing Service

What to do once you’ve found lost pensions

The first thing to do is update your details with the provider (and remember to keep them updated). Then think about finding out as much as you can about the pension:

- How much is it worth?

- When is it due to pay out?

- Where is it invested?

- Do any charges apply to the pension?

Solution to lost pensions: keep everything in one place

You may want to think about combining all your pension pots into one – to make it easier to manage. It’s not always the right choice for everyone as it depends on the type of pension you have, as well as your personal circumstances. You can get free and impartial guidance from the Money Advice Service (or Pension Wise, if you’re over 50).

As a Maji user, you can speak to one of our Money Heroes and they’ll talk through your options with you. Maji also enables you to view and manage all of your pensions in one place. No moving pensions around and no more lost pots. Just simple and easy access to keep track of your money.

Get in touch with us to find out more about how to get access to a Maji account through your workplace.

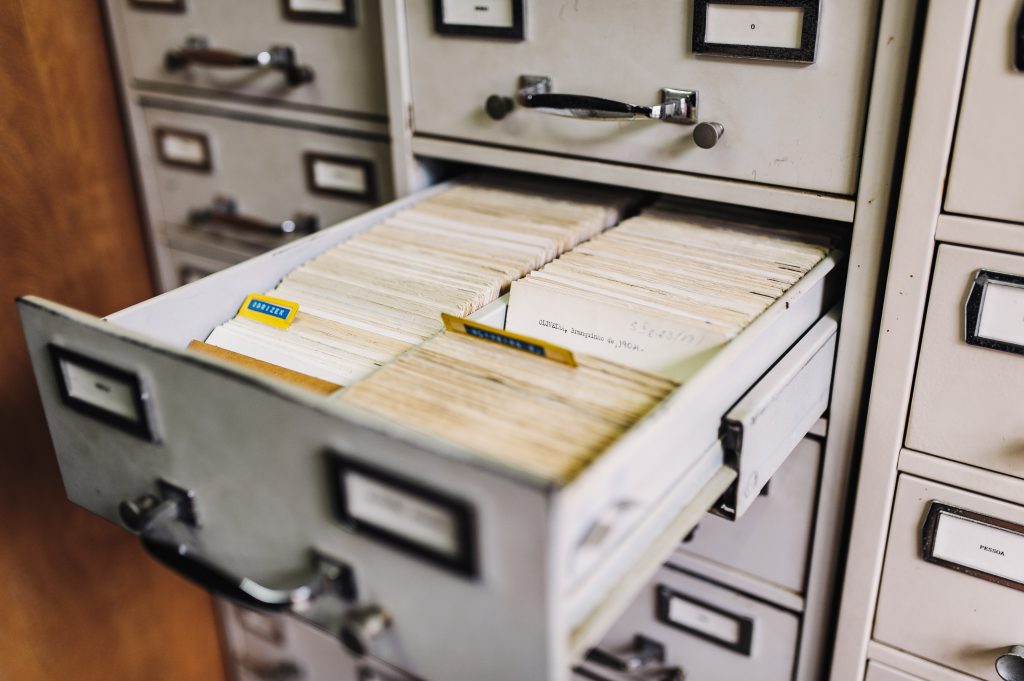

Photo by Maksym Kaharlytskyi on Unsplash