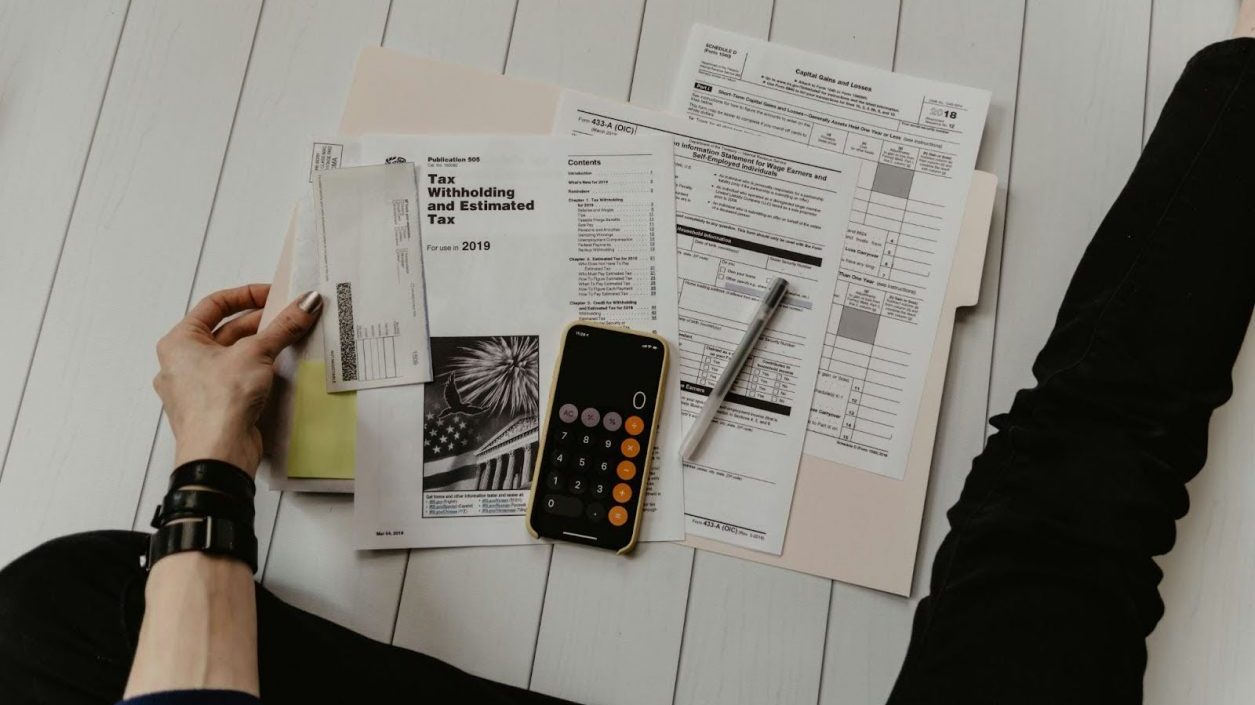

We care about financial wellbeing.

Maji is a leading financial wellbeing provider in the UK. By offering financial education, personalised 1-1 coaching and intuitive financial tools, Maji helps employers and partners improve workforce financial wellbeing, driving measurable cost savings and enhanced productivity.

Our comprehensive platform targets the root causes of financial stress, equipping individuals with the knowledge and confidence to make better financial decisions.

The meaning behind Maji

The name Maji (pronounced Mah-jee) stands for trust and respect. “Ma” represents the trust we associate with the nurturing role of mothers, while “Ji,” from our CEO Sahil’s native India, signifies deep respect.

At Maji, we recognise that every user is unique, with their own goals and challenges. Our people-first approach ensures tailored solutions, built on trust, compliance, and data protection.

Financial wellbeing is more than numbers – it’s about putting people first.

We’re on a mission…

…to build a financially secure future for everyone using a market-leading

financial wellbeing technology platform.

Help your employees thrive, not just survive –

with Maji Financial Wellbeing.

Our values

Be impartial

We don’t take commission to promote particular products or services. Instead, we provide our users with trusted, unbiased information to help them make the choices that are right for them.

Empower action and insight

Apathy. Inertia. Two big words that stop many of us from doing things we really know we should… It’s why a central aim of Maji is to make taking action easy, clear, simple and immediate.

Cut the jargon

Most of us don’t know our DB from our DC when it comes to finance. And all that technical language can be overwhelming. We are committed to simplifying financial complexities wherever we can.

Expert guidance and support

We believe the key to sustainable financial wellbeing lies in expert guidance, accountability and ongoing support. Our coaches and financial advisors are all vetted and certified.

Make a positive impact

We’re dedicated to building a business that positively impacts everyone who interacts with Maji – clients, partners, suppliers, and individual users alike.

You can trust Maji

At Maji, we understand that trust is at the heart of any financial wellbeing solution. That’s why we are committed to maintaining the

highest levels of transparency, security, and professionalism.

If you’re thinking about financial wellbeing, you should be thinking about Maji

Registered with the FCA

We are registered with the Financial Conduct Authority, ensuring the highest standards of trust and compliance in everything we do.

Trained experts

All our financial experts have gone through a thorough due diligence process, and every coach is fully trained for their role in providing financial guidance, providing your employees with reliable and professional help.

Your data is safe

With ISO 27001 certification, we adhere to the highest standards of data security. Our users’ sensitive information is protected with robust measures, ensuring their privacy and your peace of mind.

Our leadership team

Sahil Sethi

CEO

Sahil is a serial entrepreneur and visionary with a passion for empowering individuals to improve their financial wellbeing. In 2015, he conceived the idea for Maji, driven by his desire to create innovative tools that simplify personal finance management. With over 15 years of experience in building financial and technology products, Sahil combines his deep expertise with a commitment to developing technology for positive impact.

He is a CFA charter holder, holds a first-class degree in Computer Science from City University, and is a TED Institute speaker.

Megan Worthing-Davies

COO

Megan is a Teach First alumna with a decade of experience leading teams in purpose-driven organisations, particularly those focused on education and behavioural science. She holds a degree in Philosophy, Politics, and Economics (PPE) from Oxford University and an MSc from the London School of Economics, specialising in behavioural economics.

A passionate cyclist, footballer, and boat enthusiast, Megan’s early experiences as a gig worker sparked her interest in promoting financial wellbeing, having faced challenges in building financial security herself.

Read the latest in financial wellbeing thought leadership

Think Maji for your financial wellbeing.

Experience the power of a leading financial wellbeing solution that creates impact where it matters most. To see our platform in action and discover how we can support you, book a demo or contact us here to take the first step toward a brighter financial future.

We’re building a financially secure future for everyone…join us!