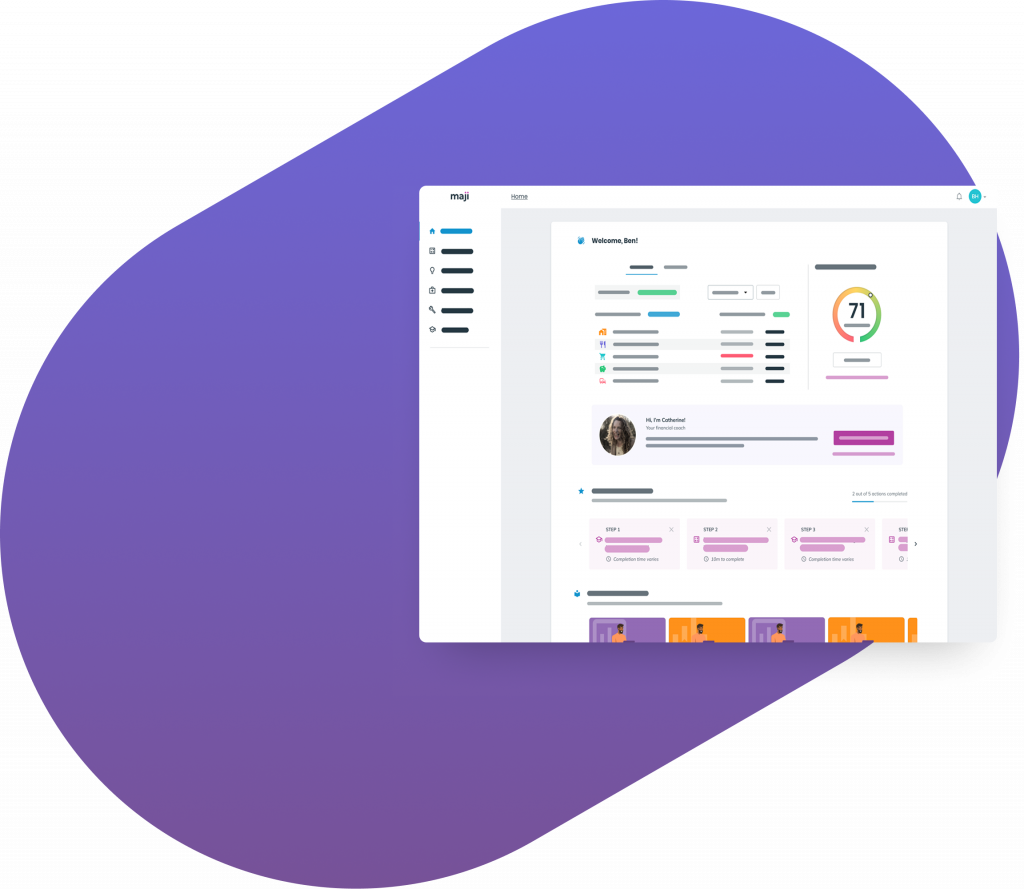

Thrive with a holistic financial wellbeing solution

Empower employees, reduce stress, and enhance productivity with Maji’s comprehensive financial wellbeing solution.

Think Money. Think Maji.

Rated Excellent by our customers

Thrive with a holistic financial wellbeing solution

Empower employees, reduce stress, and enhance productivity with Maji’s comprehensive financial wellbeing solution.

Think Money. Think Maji.

Rated Excellent by our customers

What financial wellbeing does for you

Partnering with a financial wellbeing provider is one of the most effective ways to support your people and strengthen your business. From financial education to expert guidance, the right financial wellbeing solution delivers long-term value to both employees and employers.

Financial education that empowers your team

Money tools for everyday financial confidence

Engagement that drives better ROI on your existing benefit spend

Access to expert financial guidance, when it matters most

Financial coaching

Your competitive advantage

Our certified financial coaches offer unlimited support, giving your employees access to one-on-one expert guidance whenever they need it.

Financial coaching is consistently ranked by corporate employers as the #1 most valued feature of a wellbeing programme –

and it’s at the heart of Maji’s offer.

Brilliant financial coaching session

The free 1:1 coaching session was very insightful and a great tool to discuss a sensitive, personal topic. I felt like I could speak freely with my coach about confidential information, in a judge-free environment. Their portal has lots of additional content which I look forward to learning from.

Rebecca S.

I was very impressed with my coach

I was very impressed with my coach - they were knowledgeable, empathetic and immediately understood my situation and concerns.

I left feeling positive with actionable tasks and I am motivated and keen to progress with the tasks set.

Jane

Maji is a brilliant and easy to use service.

My coach, Catherine, was very easy to talk to and I never felt like I was being judged. She took the time to understand my financial situation and was encouraging and positive.

Duncan B.

I was slightly dubious

I was slightly dubious before my meeting with my coach thinking it might be a little bland and basic. How wrong could I be! John was clearly an expert with great knowledge but also very personable. Within minutes I felt comfortable that I could talk openly. John tailored my first session around the questions I asked and the depth of knowledge (or lack of it) that I had. Really useful.

Michael H.

All great…

Very friendly and knowledgeable financial coach, who also kept it honest and to the point, which is what I needed. All great!

Stephen E.

Coaching was amazing

My Coach was Funmi, she was amazing! Explained things fully to me, I am a complete newbie so it would be easy to feel stupid or silly for not knowing things but Funmi didn’t make me feel this, she went over whatever I needed! It was great!

Charlotte H.

The business case for financial wellbeing

Financial stress reduces productivity

Nearly 1 in 2 UK employees (47%) say financial worries affect their ability to do their job.

Employees want employer support

81% of UK employees want help from their employer to improve their financial wellbeing, but only 27% feel they currently get enough support.

Financial wellbeing boosts retention

Companies that offer financial wellbeing programmes see a 22% increase in employee loyalty and retention.

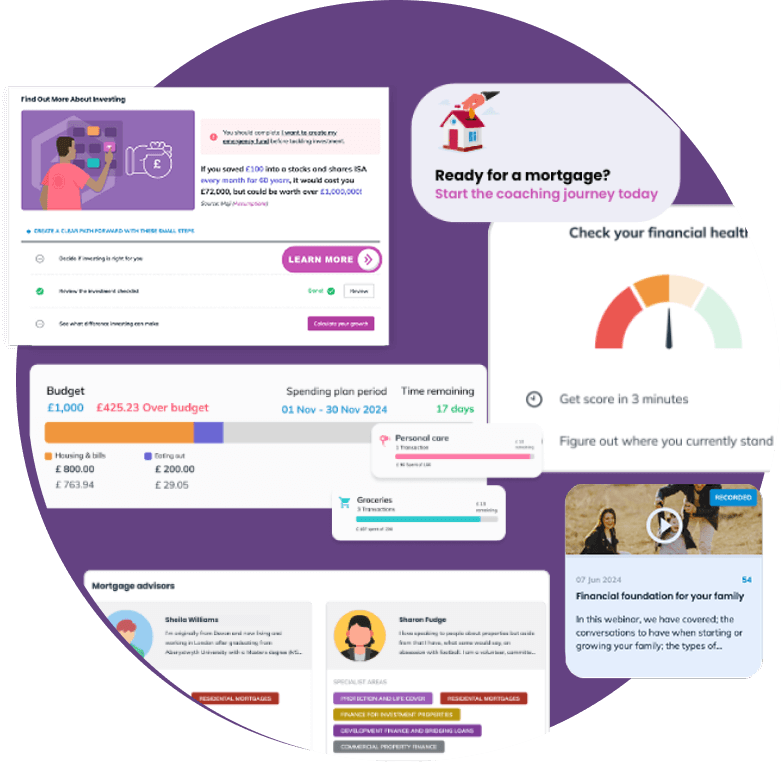

Meet your employees where they are

Financial wellbeing is for everyone. Rest assured knowing you are providing a full service solution that not only solves your employees’ everyday financial challenges, but helps you add more value to your people.

Career starters

Support younger employees with financial literacy for the best chance at financial success

New parents

Provide access to workplace nursery scheme offerings to support new parents with extra savings

Home owners

Provide mortgage guidance through money management tools and access to mortgage advisors

Older workers

Provide pension support for your older workforce as they prepare for retirement

Family builders

Support family starters with adequate tools for pension, savings and investment plans

High earners

Provide access to estate planning tools and financial experts such as financial advisors

DE&I

Support women, minorities and disabled employees with inclusive tools and programmes

Neurodiversity

Deploy a tech-forward solution that caters for employees’ individual preferences

Everyone benefits from financial wellbeing

Benefits for your business

- Track ROI with detailed reports and aggregated real-time employee insights

- Put your people at the centre of your employee benefits strategy with data driven insights

- Boost productivity by reducing financial stress and giving employees peace of mind about their money.

- Enhance your employer brand with a compelling employee benefits offering

- Retain top talent by showing your commitment to their financial security and long-term success

- Maximise benefits utilisation with an intuitive platform that caters to every employee’s unique needs and life stage

Benefits for your employees

- Improve financial literacy and confidence with accessible self-serve digital learning journeys

- Feel more confident by using intuitive financial planning and budgeting tools

- Create a financially secure future for themselves and their family through pensions, savings and debt control

- Ensure they are tracking well for retirement through automated pension contributions

- Keep accountable to your financial commitments by working with a certified financial coach

- Protect your family and estate with expert will writing and estate planning services

What’s included in your package?

Choose from a wide selection of supporting tools, features and services to create a totally bespoke package for your team.

✔ Money management tools for your employees

Financial education resources

Access to our academy with on-demand learning modules. Webinars and guides to empower employees financially

Financial planning and budgeting tools

Access to our budget tracking tool to identify weak points in your spending habits. Financial planning tools for future readiness

Pension coaching that boosts savings

Access to our pension coaching programme that helps employees build a secure future and increases your NI savings by 50%

Exclusive retail deals and discounts

Exclusive deals and discount offers from leading retail brands including grocery stores like Tesco, Asda and Sainsbury’s

✔ Access to money experts

Unlimited 1-1 financial coaching sessions

Expert guidance from certified financial coaches who help shape a financial plan

Free sessions with a mortgage advisor

Expert support to help employees navigate home buying

Free sessions with a financial advisor

Access to certified financial experts to support employees with financial uncertainties

Discounts on wills

Affordable estate planning solutions and will writing services

✔ All-in-one benefits hub

Access all your benefits in one place with ease. Add, edit, or manage your benefits seamlessly, whether they’re within or outside of the Maji offering

✔ Salary sacrifice schemes

Electric cars

Home and tech purchases

Cycle to work and more…

What you’ll get from Maji

Mobile app and web-based accessibility

Manage finances from anywhere – with iOS and Android apps as well as web application.

Tailored launch plan

Manage finances from anywhere – with iOS and Android apps as well as web application.

Detailed live reporting

Refine and optimise your employee wellness strategy with regular data insights and real-time reporting.

FCA regulated provider

Our platform is safe and regulated, with bank-grade encryption, allowing your employees to be at ease.

Read more on our blog

13 min read

Choosing a financial wellbeing provider: Your guide to financial health in the workspace

10 min read

How employers can offer financial advice

7 min read

Supporting younger employees with financial wellbeing

7 min read

Why opting out of your pension might cost you more than you think

Invest in your team’s future

Ready to transform your employee experience with a leading financial wellbeing provider? Contact us today to learn more about how Maji can support your organisation.

We’re building a financially secure future for everyone…join us!

Frequently asked questions

What is financial wellbeing?

Financial wellbeing refers to the state of an individual’s financial health, including their ability to meet day-to-day expenses, plan for the future, manage debt, and feel confident about their financial decisions.

The Money and Pensions Service provides a useful financial wellbeing definition that sums up the different areas:

‘‘Financial wellbeing is about feeling secure and in control. It is knowing that you can pay the bills today, can deal with the unexpected, and are on track for a healthy financial future. In short: confident and empowered.”

At Maji, we have used the latest academic research and industry thinking to develop our four pillars of financial wellbeing:

- Financial resilience: how well someone is able to withstand shocks to the system, such as losing income

- Money management: how someone deals with day to day money decisions and habits, like spending, saving, borrowing and budgeting

- Future planning: how well someone is prepared for long-term life goals, including retirement

- Money mindset: how someone feels about money, including their confidence and stress levels

What is financial wellbeing in the workplace?

Financial wellbeing in the workplace means providing employees with support, education, and resources to help them manage their money, reduce financial stress, and improve overall productivity and engagement.

What’s the business case for financial wellbeing?

Financial wellbeing at work is more important than ever. With over 80% of employees saying they are impacted by money worries at work, it’s clear that money stress can negatively affect your business. And, with the cost of living rising, the psychological toll is magnified, with 54% of UK adults now feeling dread, anxiety and depression as a result of concerns around finances. Developing a robust financial wellbeing policy can help support your employees through these tough times and beyond, leading them to feel more secure and happier at work.

What is an employee financial wellbeing programme?

An employee financial wellbeing programme is a structured initiative offered by employers to support staff with financial education, guidance, tools, and benefits that help them manage money effectively.

What does a financial wellbeing provider do?

A financial wellbeing provider offers solutions, tools, coaching, and resources to help employees improve their financial health, including support with budgeting, saving, pensions, and other workplace benefits.

How to support employees with financial wellbeing?

Support can include access to financial coaching, workshops, personalised guidance, digital calculators, savings schemes, and clear communications about benefits and money management.

Is financial wellbeing part of employee benefits?

Yes. Many employers now include financial wellbeing programmes as part of their employee benefits package to help staff save money, reduce stress, and plan for the future.

Does financial wellbeing help employees save money?

Yes. By providing education, salary sacrifice options, and budgeting support, financial wellbeing programmes can help employees increase savings and make smarter financial decisions.

Why is financial wellbeing important for employees?

Financial wellbeing reduces stress, increases focus and engagement at work, and improves employees’ ability to plan for both short-term and long-term financial goals.

Does Maji offer bespoke company webinars?

Maji offers a bespoke and extensive webinar programme. In addition, your employees get access to monthly Masterclasses following Maji’s Money Curriculum.

What is the difference between coaching and advice?

Financial advisors recommend specific financial products or investments as a solution or next step for individuals seeking advice about their financial situation. The FCA regulates all financial advisers including mortgage, equity release, pension and investment advisers and sets the minimum standard of qualification and demonstrated competency including ongoing professional development and good financial behaviour.

The training and competent adviser status expected by the FCA in itself means the adviser has a minimum of two years financial industry experience. The FCA authorisation process also checks professional references, positive financial behaviours (conduct) and identification.

Financial coaches do not offer specific recommendations. They can guide groups or individuals through financial wellbeing and education sessions and support them into positive financial habits that in turn improve their financial situation and overall wellbeing. Financial coaches help with things such as:

- Providing generic guidance

- Sharing financial knowledge and information

- Empowering individuals to change behaviour

- Providing accountability for individuals who want support to change

- Helping individuals reflect on and identify actions that will improve their financial wellbeing

- Helping individuals use specific financial tools such as budgets or financial plans

There is currently no set expectation for Financial Coaches, Financial Wellbeing Specialists or Financial Educators to be regulated by the FCA. This is because there is no financial product involved nor a specific written and verbal recommendation tailored to an individual’s personal circumstances.

Whilst there are no regulatory requirements for qualification for these roles, Maji sets a high internal standard of professional experience, finance knowledge and personal skills for these specialists, as set out in our Expert Due Diligence Policy.

How can organisations measure financial wellbeing success?

Success can be measured by employee engagement with programmes, improved financial confidence, increased savings participation, and reduced financial stress among staff.