Table of contents

What is a default fund?

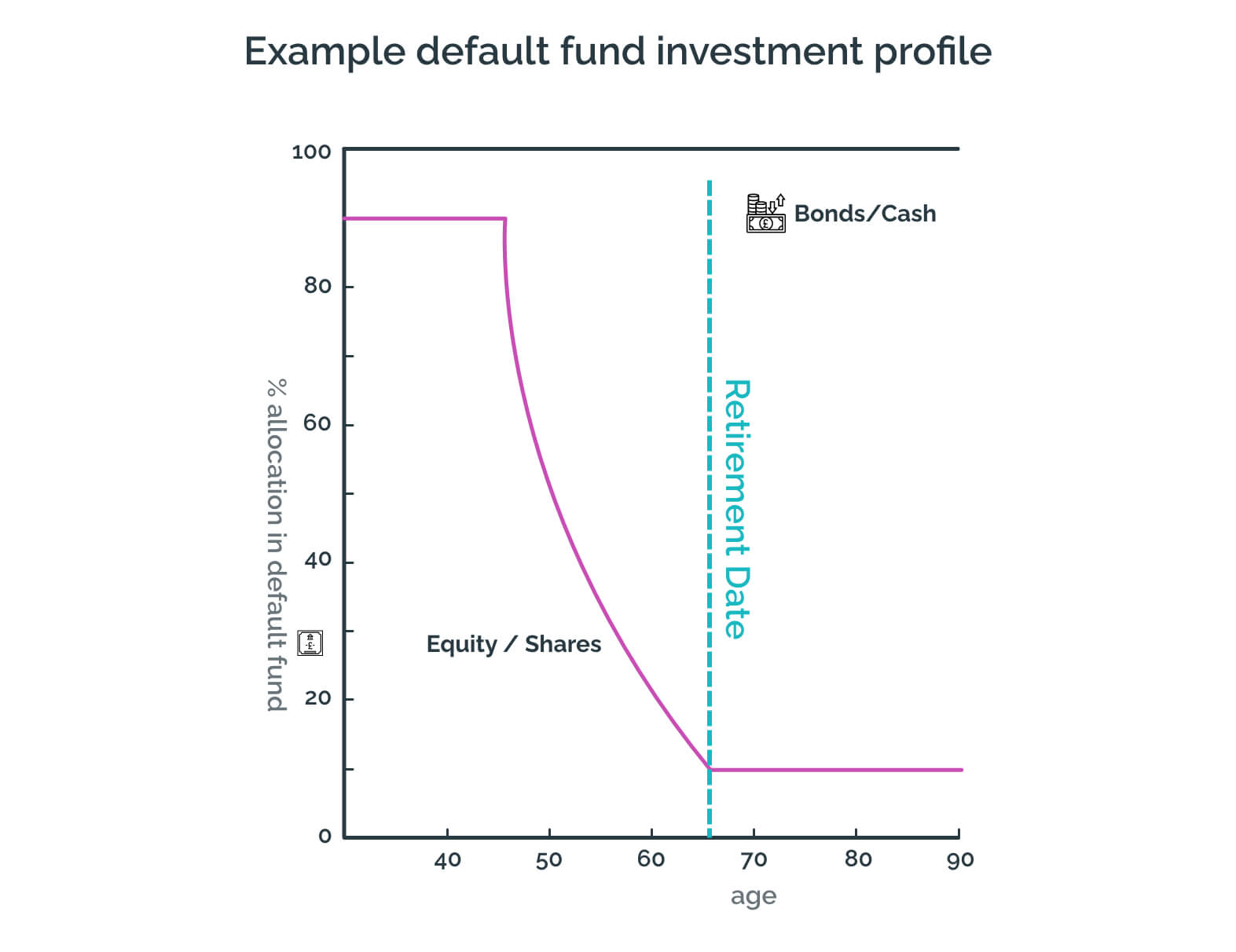

“Default” fund: A fund is where your money is pooled with other people’s in a mix of investments. The default fund/range of funds is where your money is invested if you do not choose where to invest it in a workplace pension scheme. The default fund is usually managed for you, often to control risk level as you get older.

If your money is in a default fund, you are not alone! Nearly 90% of people saving into a workplace pension end up investing in the default fund.

However, nearly all pension providers offer a range of fund choices that allow an individual to take more or less investment risk or invest in other funds according to their beliefs. These might include ESG (Ethical, Social and Governance), Sharia, or a higher risk fund.

So why is the number of people in default funds so high? For two main reasons:

- Lack of interest in the pension scheme

- Lack of investment knowledge

Whilst the default fund is fine for many people, you might not realise the potential impact of not taking more investment risk by changing where your investments go. In this article, we’ll tell you more about why you might consider moving your money, and how to decide if it’s right for you.

The impact of increasing your return

Return on investment happens when your fund does well and your money grows over time. With a higher risk investment, you might get a higher rate of return.

Eeking out an extra 0.5% return per year might mean an extra £100K* in the average pension pot over a lifetime!

The impact might be even higher for you. Why? Because we calculated this number based on two major assumptions:

- An investment span of 50 years

- This person contributes 8% of their before-tax pay into their pension every year

The impact will be higher if the investment span is longer, because your money just has longer to grow.

For example, I am 37 right now and have a 1 in 4 chance of living to 93; that’s an investment span of 56 years. But since I started working at 21, my investment span might really be close to 75 years! And that is likely to be the investment span of most people.

The impact will also be higher if I save more than 8% into my pension.

The recommended savings rate for most people is 12-15% of their salary from the time they start working. The more money I put in, growing at a higher rate of return, the more money I will have at the end.

So you want the extra return? Well, extra return is not free

There is no such thing as a free lunch. Potential of more return means potential of more risk, specifically investment risk. Investment risk simply means there is a range of results you may get if you invest your money. The higher the investment risk, the wider the range of results. For example, you invest £100 in a hypothetical fund in which there is a possibility that at the end of 10 years, you might get between £80 to £250 back. Investing the same £100 in a fund that has more investment risk might mean you may get back £60 to £300 ie. you may gain an extra £50 but you may also lose an extra £20. Investment risk is only one of the risks that you are exposed to when saving for your goals; to see the other main types of risks see our article:- Find out what risk means and the risk you face when saving for your goals

There is still investment risk in the default fund, it’s just that it might be lower than the other investment options on offer, hence the potential of lower return.

Why aren't pension providers trying to get more return?

The short hand answer is that they are. Who wouldn’t want to? However, they are constrained by how much investment risk they can take in the default fund as that fund is used by a lot of people and the pension provider does not know how much investment risk they want to take. Hence, pension providers tend to err on the side of caution and create default funds that are generally a few notches lower in the investment risk department.

Ok, let's prove the point

The two biggest workplace pension providers in the UK are Nest and The People`s Pension. They both are very open about their information and publish it on their websites. I have take information shown on their websites and compared the performance of their default fund over the past 5 years with the alternative fund that they offer for individuals who want to take more investment risk:

The People’s Pension

The default for The People’s pension is the Balanced investment profile which invests in a range of funds over a pension saver’s lifetime. The fund in which a saver’s money is invested for the majority of their working life is the “Global Investments up to 85% Shares” fund.

The alternative investment profile offered by The People’s Pension is called Adventurous. The main difference between this and the Balanced profile is that the 85% Shares fund is replaced by a 100% Shares fund. The Adventurous profile has higher investment risk but the potential of higher returns.

Here are the cumulative returns for 5 years to 30th April 2021 after fees for both of these funds:

Nest

The default fund for Nest depends on a pension saver’s retirement age. It’s one fund for life and the pension provider changes what that fund invests in (reducing the investment risk) as the person gets closer to retirement. For ease of comparison, we will use one of these funds called the 2040 fund. We will compare it with the “Higher Risk” fund that Nest offers.

Here are the cumulative returns for 5 years to 31st March 2021 after fees for both of these funds:

In both the cases, you would have done much better choosing the higher risk fund. Repeat this for the next 50 years and you can figure out how much extra you could end up missing. Although past performance is not an indicator of future performance, the higher risk funds have been created on the theory that they should generate a better return. It’s the reason they were created!

Imagine being docked 15-20% of your pay today because you didn’t brush up on your investment knowledge….if that isn’t acceptable to you today, don`t make your “future you ” suffer it either. Your “future you” will be dependent on the money in your pension account for 25-40 years.

So, if you are ready to take some action, here are the things to do and keep in mind

Figure out whether you need the extra return in the first place. You might be on track for your income goal already. If you want to see whether you are on track or not, work out what your retirement income is looking like by using a retirement calculator. If you are a Maji customer, you will have access to our financial planner. If you are not, you can use this one https://www.moneyadviceservice.org.uk/en/tools/pension-calculator

- If you do indeed want to move your money, make sure you are comfortable with taking the extra investment risk

- Log into your pension account to see which other fund options are available. If you are not comfortable choosing funds yourself, get a financial advisor or don’t do it.

- As you get closer to retirement (usually 10-15 years from your retirement date), your pension provider will lower the investment risk in a default fund to reduce the chance of a large fall in your pension pot. This is done by moving money into assets that are less risky. If you move your money into a fund that does not do that automatically for you, you will need to regularly review your investments (around once a year) and move the money between funds yourself to keep it in line with your retirement goals. Or you can just move it back into the default fund at this point if you want to remove the hassle.

If you have any questions, hit the chat button on Maji. We can’t provide any financial advice but can answer any factual questions and also put you in touch with experts who can help you make the right choices.

*A 21 year old with a starting salary of £30,000 that grows by 2.5% every year. This person saves 8% of their gross salary in a pension fund. The pension fund can grow at either 5 or 5.5% through this time.

Photo by Kelly Sikkema on Unsplash