Table of contents

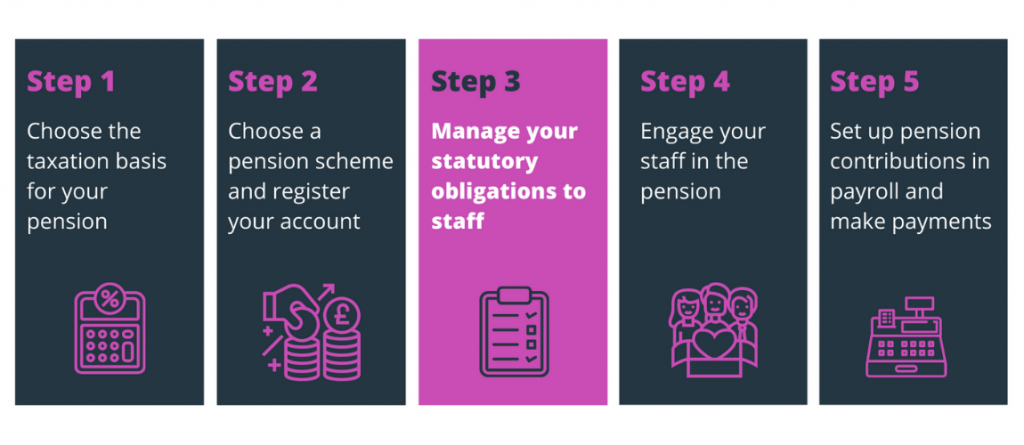

The third article in our series about how to set up a workplace pension scheme.

You’ve set up your workplace pension scheme (using our Pensions 101 Guide Parts 1 and 2). Congratulations! But the job doesn’t stop there. You’ll need to keep on top of your statutory obligations to your staff to make sure your pension scheme remains compliant. Never fear: we’re here to let you know what you’ll need to do.

1. Assessing your workforce

Before you enroll your employees into the pension scheme, you’ll need to assess their eligibility. This means looking at the employment status, age and earnings of each employee.

On a basic level, you need to carry out an assessment by or on the very first day you employ somebody in your company. This is the legal start date of your obligations. You can also carry out a postponement to delay this process.

Firstly, you will need to assess who in your company is considered a ‘worker’.

The official definition of a worker is someone who:

- works under a contract of employment (an employee) OR

- has a contract to perform work or services personally and is not self-employed.

Next, you will need to use your workers’ ages and gross earnings to assess your obligation towards them when it comes to enrolling them and paying into their workplace pension. You’ll also need to regularly reassess your employees to check if their status has changed.

An ‘eligible jobholder’ is someone who must be auto-enrolled into the pension scheme. You will also need to make employer contributions to this person’s pension. Therefore, it’s important to know who falls into this category. Additionally, non-eligible jobholders and entitled workers can choose to opt into the pension scheme.

You can find more details of how to assess your employees via the Pensions Regulator. The good news is that Maji will assess your employees for you, and tell you who needs to be enrolled into the pensio

2. Enrolling eligible employees

Once you know who needs to be auto-enrolled into the pension (any eligible jobholders), and if any of your non-eligible jobholders or entitled workers have opted in, you need to add these employees to the pension scheme.

You have six weeks from the employee’s first start date to either complete the enrolment or trigger postponement. Postponement allows you to delay the start of your pension duties for up to three months. For example, this could work if you have a probation period for your staff. You’ll need to send your employees written notice, letting them know when they will be enrolled. It’s easy to send this notice through Maji.

Either by the end of the six-week joining window, or after the postponement period is up, you’ll need to have added the employee(s) to the pension scheme.

3. Managing opt-ins and opt-outs

Opt-outs: Some of your employees may choose to opt out of the pension scheme. This can be done within one month of the employee either receiving information about their pension scheme, or being added as an active member of the scheme (whichever is latest). It’s the employee’s responsibility to opt out via their pension provider within this time. They should also send a notification to you through Maji. You can then check with the pension provider that they have been removed from the scheme, and ensure no more contributions are taken from payroll. You may also need to refund any contributions taken after their opt-out request was made.

Opt-ins: A non-eligible jobholder or an entitled worker can request to join the workplace pension scheme, even though they are not auto-enrolled. Additionally, someone who has opted out may request to rejoin the scheme. You’ll need to add them to the scheme and make sure contributions are set up on payroll within six weeks.

You will need to keep records of all opt-outs and opt-ins. By using Maji to manage such requests, an automatic and easily accessible record will be created.

4. Communicating with employees

You’ll need to send all your employees information about their assessment and enrolment. You can find letter templates via the Pensions Regulator here, or use Maji to send the right information at the click of a button.

5. Ongoing duties

With all the set-up complete, and your employees enrolled, you’ll now need to manage the pension scheme on an ongoing basis:

- You must continue assessing your workforce to see if anyone is now eligible for enrolment (i.e. their age or earnings changed).

- Every three years you must carry out re-enrolment to put back in any staff who have opted out of your scheme.

- You will also need to continue paying into your pension scheme, manage requests to join or leave the scheme, and keep records.

Maji will remind you when your automatic re-enrolment date is coming up. Don’t forget – you will need to complete a Declaration of Compliance within five months of your original duties start date, and re-declare when it’s time for re-enrolment.

Making pensions simple with Maji

It can feel like there’s a lot to get your head around when it comes to keeping up with your statutory obligations. Maji’s digitised pension management system can help you:

Check back next month for Part 4, where we’ll cover how to engage your employees with their workplace pension.

Get in touch to learn more about how Maji can help you unlock the hidden value of your pension for your company and your employees.

Read more in the Pensions 101 Guide for Employers series: 1, 2, 4, 5, 6