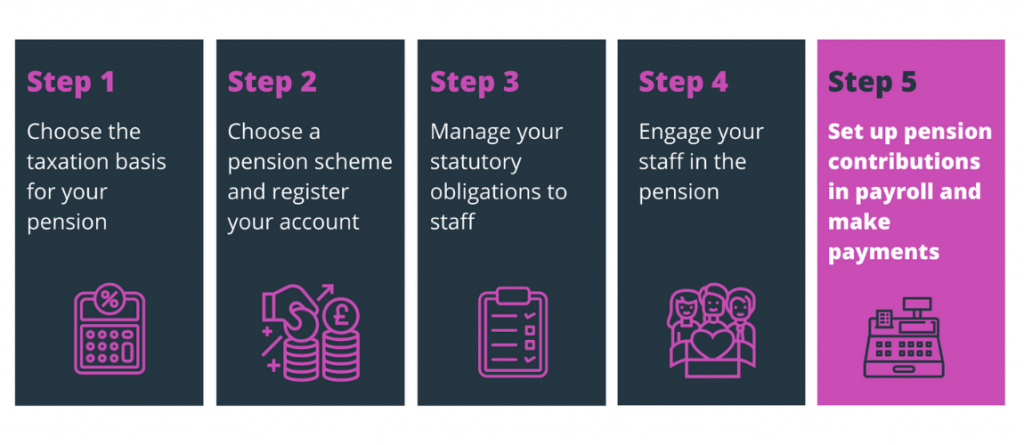

Welcome to the final part of our series, ‘Pensions 101’, aimed at small business owners setting up their first workplace pension scheme.

In this blog, you’ll learn more about setting up your pension scheme and payroll system so you and your employees are paying into the scheme on time.

Table of contents

Getting started

You should have already set up your pension scheme with your chosen pension provider, including details of what your standard contribution rate will be.

Contributions amounts are usually expressed as a percentage of earnings, so your pension provider will need you to confirm each employee’s earnings with them.

With your pension scheme set up, you’ll need to make arrangements to pay in regularly.

Payment due date

The payment due date is the date you agree with your pension provider, by when you’ll make contribution payments for each pay period (e.g. each month, if you pay your team monthly).You have to pay your pension provider or trustee by law no later than the payment due date. The Pensions Regulator may fine you a fixed penalty of £400 as a consequence of not paying the correct contributions on time with an escalating penalty which accrues daily if payments are still not paid. You must pay employee contributions no later than the 22nd of the month (or 19th if you pay by cheque) following the month in which you deducted them, unless you’re holding on to contributions during the employee’s opt-out period. So, if your pay reference period ends on May 25th, the latest date for payment would be June 22nd.

There are special rules for the first deduction of contributions on automatic enrolment under the Pensions Act 2008. To account for staff who may decide to opt out and therefore would need a refund, you may be able to pay the whole first three months in one go in the fourth month – check with your pension provider for more information.

Oversight of your payments

Your scheme provider (or trustees) will monitor that you pay the correct contribution to your employees on time and may report you to the regulator if you do not. They will also tell the members of the scheme that you have not paid on time or in full.

Separately, The Pensions Regulator will monitor the contributions that are paid into your workplace pension and can tell if payments that are due are not being made into your staff’s automatic enrolment scheme. The Pensions Regulator will take action if you fail to comply with your ongoing legal duties, and you may need to backdate any missed payments.

Keeping your pension provider informed

It’s important that you keep information on pay contributions and membership up-to-date and inform your scheme provider of any changes. These should include:

- any changes to an individual member’s earnings or contribution entitlement

- members leaving or joining the scheme

If your payroll syncs with your pension provider (see below), you may only need to update these changes on the payroll software and they will automatically be transferred across.

Setting up your payroll

Think carefully when choosing a payroll software. The right software could help you:

- Automatically send through the required information to your pension provider without the need for you to upload or email a file (pension syncing).

- Calculate how much you and your employees will need to contribute each pay period and then ensure that the correct tax relief is calculated in addition.

- Set up different pension arrangements like salary exchange.

When you get started with your payroll software, you’ll need to set up your pension scheme details and make sure these match what you’ve chosen from your pension provider. You’ll also need to make sure that, if your software syncs with your pension provider, that your information is transferred each month when you run the payroll. Otherwise, you’ll need to manually update your pension provider with the correct information for each pay period.

Get in touch to learn more about how Maji can help you unlock the hidden value of your pension for your company and your employees.

Read previous segments in the ‘Pensions 101 Guide for Employers‘ series:

Part 2: Setting up your workplace pension scheme