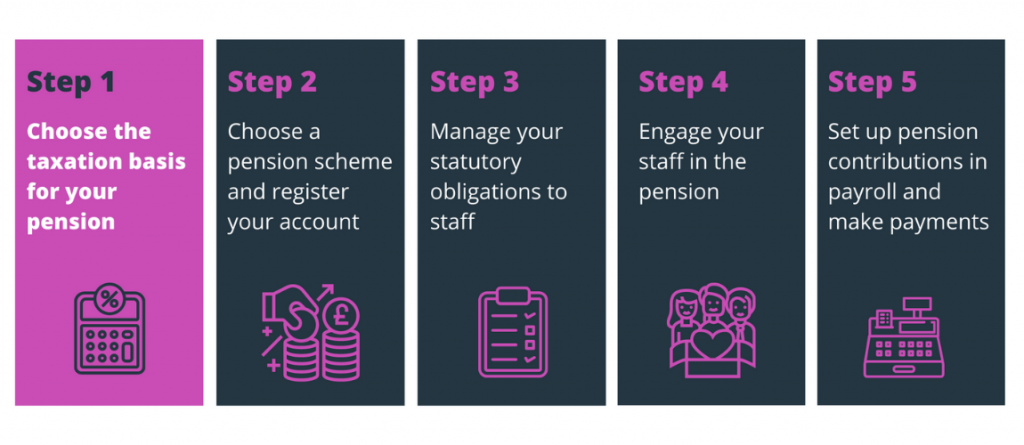

Th is the second article in our series about how to set up a workplace pension scheme.

So, you’ve read our Pensions 101 Guide for Employers Part 1. You’re now familiar with what a pension is and what auto-enrolment means. You’re ready to set up a workplace pension scheme for your business, enrol your eligible employees and start fulfilling your statutory obligations.

Table of contents

When do you need to set up your pension scheme?

As a new employer, your pension auto-enrolment duties start as soon as you bring in your first employee. So, you’ll need to have your workplace pension scheme set up before this date.

You can choose to postpone your duties, which gives you three extra months to assess who to enrol on the pension scheme and get the details finalised. You must notify employees of the postponement within six weeks and one day of the starting date (usually the date they start working for you). You can find more details of how to notify your employees at the Pensions Regulator website, or you can send your notification through Maji at the click of a button.

How do you choose a workplace pension scheme?

There are lots of pension providers out there offering Defined Contribution workplace pension schemes. You’ll need to choose a provider that works for you and your employees.

You may want to consider the following:

- Check the set-up costs and the ongoing charges you and your employees will pay. In some instances, there will be no fee for the employer, but there will be charges for the employee. Most likely, a large pension provider designed for multiple employers of different sizes will be the most cost efficient.

- Check the method of tax relief the scheme uses and ensure you choose one that has the option you want.

- Check whether the payroll software you use is integrated with the pension scheme you are choosing. This can save you admin time when it comes to running your monthly payroll and submitting your pension data.

- Consider what other services the pension provider offers. Some examples include free financial advice, enhanced options for your employees to control their investments or dedicated online support channels.

How do you choose what kind of tax relief you’ll use?

You can choose to set your tax relief as relief at source, also known as ‘net tax basis’. This is usually the default offered by pension providers. Pension contributions are withdrawn from an employee’s salary after tax. The pension provider then claims the tax relief (at 20%) and adds this to the contribution. The advantage is that this applies even to employees who don’t earn enough to pay tax. However, the tax relief takes about six weeks to come through. Additionally, higher rate taxpayers will have to claim their extra tax relief (over 20%) when they submit their tax return.

This kind of tax relief basis would be better if you have more employees on low salaries. This is because the tax relief will apply to all employees, even if they don’t earn enough to pay tax.

You could also opt for a net pay arrangement, also known as ‘gross tax basis’. Employee contributions are withdrawn before tax. This means that tax relief is applied straight away because no income tax is paid on money going into the pension. However, employees who don’t earn enough to pay tax will not be able to get tax relief.

This kind of tax relief would be better if you have more employees in the higher rate tax bracket. This is because, under a relief at source arrangement, they would have to manually claim their extra tax relief from HMRC. With a net pay arrangement, the automatic tax relief saves them this hassle.

You will need to consider the type of employees you have (or are likely to have in the future) and their income levels in order to make a decision. You can find a summary of which of the main pension schemes use which tax basis here.

How do you decide what contributions to make to your employees’ pensions?

The minimum amount an employer must contribute to a pension is 3% of an employee’s qualifying earnings. In total, as of April 2019, a minimum of 8% of qualifying earnings must be paid into a pension. An employee will usually contribute the rest (so if an employer gives 3%, the employee will give 5%).

Qualifying earnings means that you are giving a portion of the earnings that fit within the ‘qualifying band’. This is the default for most workplace pension schemes.

The exact figures for qualifying earnings are reviewed each year by the government. For 2023-24, qualifying earnings are between £6,240 and £50,270. That means the amount from which the contribution is calculated is the amount between the lower and higher boundaries.

Instead of making contributions based on qualifying earnings, you might choose to base your contributions on an employee’s total earnings. There are three options for this set out by the Pensions Regulator (see point 110), depending on how much their salary is affected by bonuses, commission or other extra earnings.

How have other companies set up their pensions?

A survey of FTSE100 companies in 2019 (run by WillisTowersWatson) shows that the average employer contribution is 8.3% (falling to 6.1% for the FTSE 250). This suggests larger companies are more likely to contribute more than the minimum of 5%. Only 50% of companies overall offer more than the minimum contribution.

The advantage of offering a higher employer contribution is that it can help you recruit and retain high calibre staff. Of course, this will also make each staff member more expensive.

A number of companies offer a matching scheme, where the employer makes an extra contribution to match the employee contribution.

A matching scheme could be another element of employee reward and engagement. Again, the benefits of employee recruitment and retention must be weighed against the increased expense. Many employers cap their matched contributions for this reason.

Differentiating your pension offer with Maji

As a new business, you may not yet be in a position to offer more than the statutory contributions. By offering a Maji account to your employees, you’ll help them understand their workplace pension and get their savings on track for a bright financial future. And, you’ll be giving them a benefit that 75% of users rate as or more valuable than other workplace benefits.

Get in touch to learn more about how Maji can help you unlock the hidden value of your pension for your company and your employees.

Read previous segment in the ‘Pensions 101 Guide for Employers‘ series:

Read the next segments in the ‘Pensions 101 Guide for Employers‘ series:

Part 3: Manage your statutory obligations to staff

Part 4: Engage your employees with their pension

Part 5: Set up payroll pension contributions and make payments