Salary sacrifice

schemes

An NI and tax saving solution tailored for SMEs –

save money for your business and your people

with salary sacrifice schemes.

Think NI savings. Think Maji.

The benefits of salary sacrifice schemes

Increase take-home pay for employees

Help employees keep more of what they earn through tax-efficient benefits.

Attract and retain top talent

Stand out in the market with a benefits package that employees love.

Boost employee wellbeing

Reduce stress and empower your team with tools and education for financial security.

Types of salary sacrifice schemes

✔ Salary sacrifice schemes

Pension salary sacrifice

Childcare salary sacrifice

Cycle to work

Home and tech purchases

Electric cars

Calculate your savings

Use our NI savings calculator below to instantly estimate your tax savings by offering salary sacrifice benefits.

Schemes

Savings

Number of employees taking up benefit

Employees

Pension salary sacrifice

£0

Pension coaching

£0

0

Workplace nursery

£0

Electric car

£0

Cycle to work

£0

£0 a year in savings

Estimates are based on certain assumptions

Assumptions

- Assume pension contributions on full salary, with average employee contribution of 5%

- On average 40% of employees increase pension contributions from pension coaching

- UK average nursery fees of £15,600pa. On average 7% of employees have children at nursery

- Average savings per car leased are £1000 pa

- UK average spend on cycle equipment is £900

- NI rate of 15%

Contact us now for a more accurate savings calculation

Boost your employee benefits package with Maji

When you sign up to Maji as an employer, you’ll not only reduce your NI bills but also support your employees with valuable tools and resources to manage their money better.

Here’s what you’ll get from Maji as part of our financial wellbeing platform:

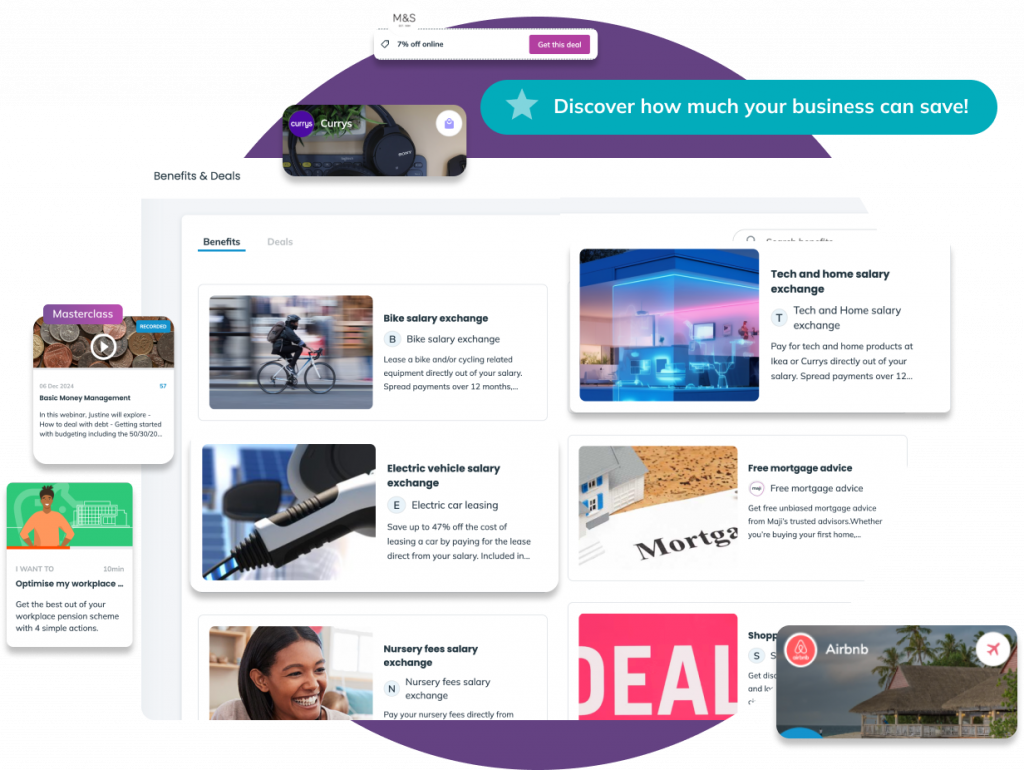

✔ Money management tools for your employees

Financial education resources

Access to our academy with on-demand learning modules. Webinars and guides to empower employees financially

Financial planning and budgeting tools

Access to our budget tracking tool to identify weak points in your spending habits. Financial planning tools for future readiness

Pension coaching that boosts savings

Access to our pension coaching programme that helps employees build a secure future and increases your NI savings by 50%

Exclusive retail deals and discounts

Exclusive deals and discount offers from leading retail brands including grocery stores like Tesco, Asda and Sainsbury’s

✔ Access to money experts

Unlimited 1-1 financial coaching sessions

Expert guidance from certified financial coaches who help shape a financial plan

Free sessions with a mortgage advisor

Expert support to help employees navigate home buying

Free sessions with a financial advisor

Access to certified financial experts to support employees with financial uncertainties

Discounts on wills

Affordable estate planning solutions and will writing services

✔ All-in-one benefits hub

Access all your benefits in one place with ease. Add, edit, or manage your benefits seamlessly, whether they’re within or outside of the Maji offering.

How salary sacrifice works

Salary sacrifice schemes are a simple, tax-efficient way to save money for your business and your employees. Here’s how it works:

Employee agreement

Employees agree to give up a portion of their gross salary in exchange for a non-cash benefit, such as pension contributions, electric cars, or childcare

Tax and NI savings

The sacrificed portion of their salary reduces taxable income, lowering the employees’ National Insurance (NI) and income tax liabilities

Cost neutrality for employers

Employers save on NI contributions while offering high-value benefits, reducing the effect of increased NI costs

Immediate impact

Employees enjoy more take-home pay or valuable benefits, while employers reduce costs – creating a win-win situation

Salary sacrifice is quick to set up, fully compliant with UK regulations, and a proven way to save money while supporting your workforce.

Why Maji for salary sacrifice?

With Maji’s expertise in supporting SMEs with valuable financial wellbeing technology, this partnership delivers a solution that works for you, your employees, and your bottom line.

Think NI savings. Think Maji.

The easiest way to get started is to book a meeting with our team who can answer any questions or map out your potential savings depending on your requirements.

From there, we’ll send you a proposal to take to your business.

FAQs: Salary sacrifice schemes

Salary sacrifice is a voluntary arrangement where your employees agree to reduce their gross salary in exchange for a specific benefit that you provide as their employer.

Salary sacrifice benefits both your business and your employees:

For employees: It allows them to save on tax and National Insurance contributions while accessing valuable benefits like pension contributions, childcare, or company cars.

For employers: It reduces employer National Insurance contributions, making it a cost-effective way to enhance your benefits package.

While salary sacrifice schemes can be highly beneficial, they can also be complex to manage initially. In order to ensure you are HMRC compliant, it is advised to implement any salary sacrifice schemes with a trusted financial wellbeing provider.

Book a meeting to decide on your package and sign up with Maji. From there, you’ll be able to setup a 1 hour implementation call, then we handle all the rest…

Implementing a salary sacrifice scheme involves a few straightforward steps. First, we’ll help you review your business structure and employee needs to determine the best benefits to offer. We’ll then support you in communicating these benefits to your team. Our team will assist with the HR, legal, culture and payroll implications, provide all necessary documentation, and ensure compliance with HMRC guidelines. We make the process seamless, so you can start offering valuable benefits with minimal hassle.

Yes! We offer a user-friendly app that allows employees to easily manage their salary sacrifice benefits. They can access their savings, review the benefits available to them, and make adjustments directly from their phones. The app also provides updates on their contributions and savings, making it easier than ever to stay on top of their benefits.

Absolutely! One of the key advantages of salary sacrifice is its flexibility. You can add a variety of benefits to your package, such as childcare, pension contributions, cycle-to-work schemes, and more. As your company grows or your employee needs change, we can work with you to tailor and expand your benefits offering to maximize employee satisfaction and retention.