Table of contents

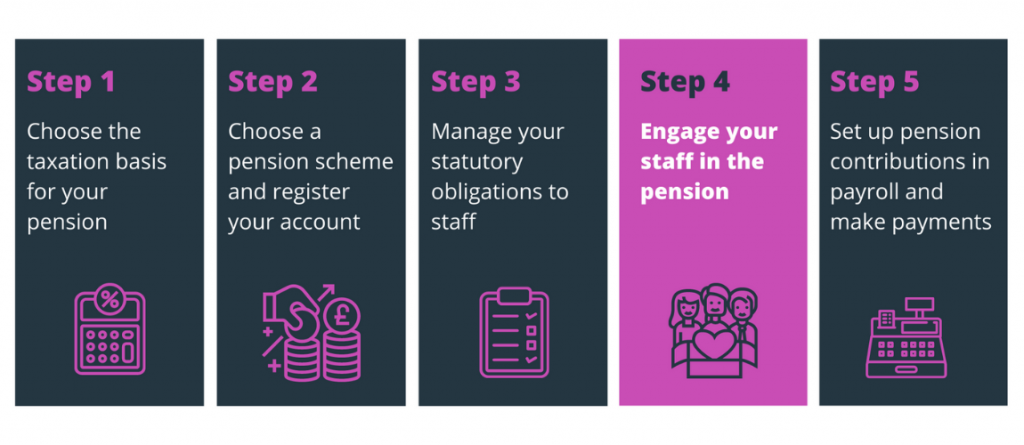

The fourth article in our series about how to set up a workplace pension scheme.

Once your pension is up and running (see our Pensions 101 Guide Parts 1, 2 and 3), you’ll be making a sizeable contribution to your employees’ pensions each month. In this way, you are supporting your employees’ futures. But are your staff engaged with this important benefit? In this blog, we set out why engagement matters, and how to encourage it.

Why do you need to engage employees with their pension?

77% of eligible employees now have a workplace pension (ONS 2020). However, studies show that employees can be disengaged:

- Over 50% of people don’t understand their pension scheme (HR Zone 2019)

- 28% of employees never check their pension or think about it at all (Atlas MasterTrust 2019)

- 77% of employees feel they don’t know enough about their pension to make informed decisions (Atlas MasterTrust 2019)

- Only 12% of businesses are happy with the level of employee engagement with their pension (CBI/Aegon 2018)

There are some clear financial implications for your employees when they don’t engage fully with saving and planning for retirement. And money worries can lead to loss of productivity.

Beyond safeguarding your employees’ futures, helping them engage with their pension can have an immediate positive impact on your business. £133bn was paid into workplace pensions in the 2019/2020 tax-year (CBI/Aegon), making it a significant (and expensive) benefit that is currently under-appreciated. When employees understand the value of their workplace pension, you can improve your recruitment, retention and the trust your employees place in you.

How to engage employees with their pension

There are a number of things employers can do in order to increase engagement:

- Give your employees a clear starting point with default contribution levels. Explain what these mean and how to change them

- Consider offering a matching scheme to encourage your employees to save more

- Give access to easy-to-use tools, such as comparisons and calculators, to support active choices

- Provide more detailed, jargon-free information for those who want to delve deeper into how the pension works

- Recognise that they have other financial needs and goals alongside pension savings

- Make space for questions and discussions about the workplace pension

"Real engagement is about driving genuine awareness and knowledge of pensions, empowering members to make proactive and informed decisions and to understand the implications of these decisions" - Roz Watson, Head of Engagement at Atlas Master Trust, 2019

Maji makes it easy to engage your employees with their pension

Maji provides an all-in-one solution to the problem of engaging employees with their pension. We help you create an engaged workforce from the very start of their enrolment into the pension scheme. Then, we maintain their engagement through regular communication, interactive tools and detailed educational content.

Get in touch to learn more about how Maji can help you unlock the hidden value of your pension for your company and your employees.

And check back next month for Part 5, where we’ll cover how to get your payroll set up for making regular pension contributions.

Read more in the Pensions 101 Guide for Employers series: 1, 2, 3, 5, 6