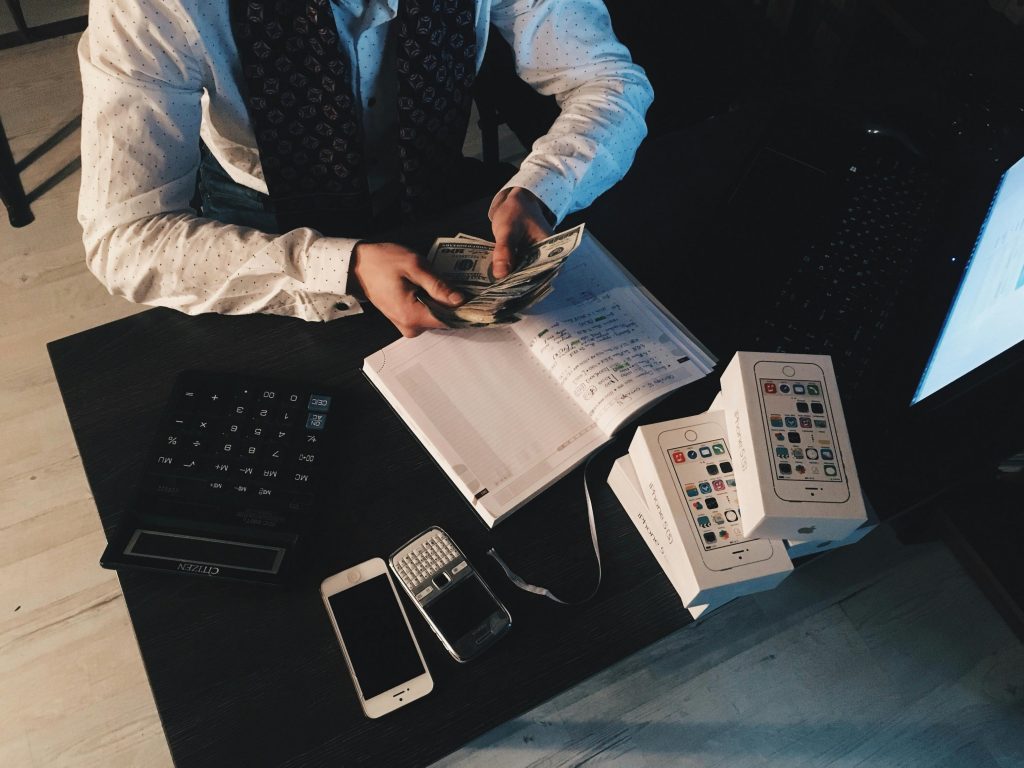

Just like working with a sports coach, working with a financial coach can help you identify your current strengths and weaknesses, make a plan to hit your goals and take action towards your desired financial future. We’re here to break down why you should consider connecting with a financial coach to boost your financial wellbeing […]

Achieve financial wellbeing with expert financial coaching