Childcare salary

sacrifice

Save your employees up to 47% per month with childcare salary sacrifice (also known as workplace nursery scheme).

Think childcare savings. Think Maji.

What is childcare salary sacrifice?

Childcare salary sacrifice, otherwise known as a workplace nursery scheme, is a cost-effective way for employers to enhance their employee benefits package while saving on National Insurance (NI) contributions.

By allowing employees to exchange a portion of their gross salary in return for their childcare contributions, you provide a tax-efficient solution that helps employees save on childcare costs while reducing your business expenses.

✔

Over 2000 eligible nurseries

✔

Average savings of £6,500 per child

✔

Reduce the impact of NI costs

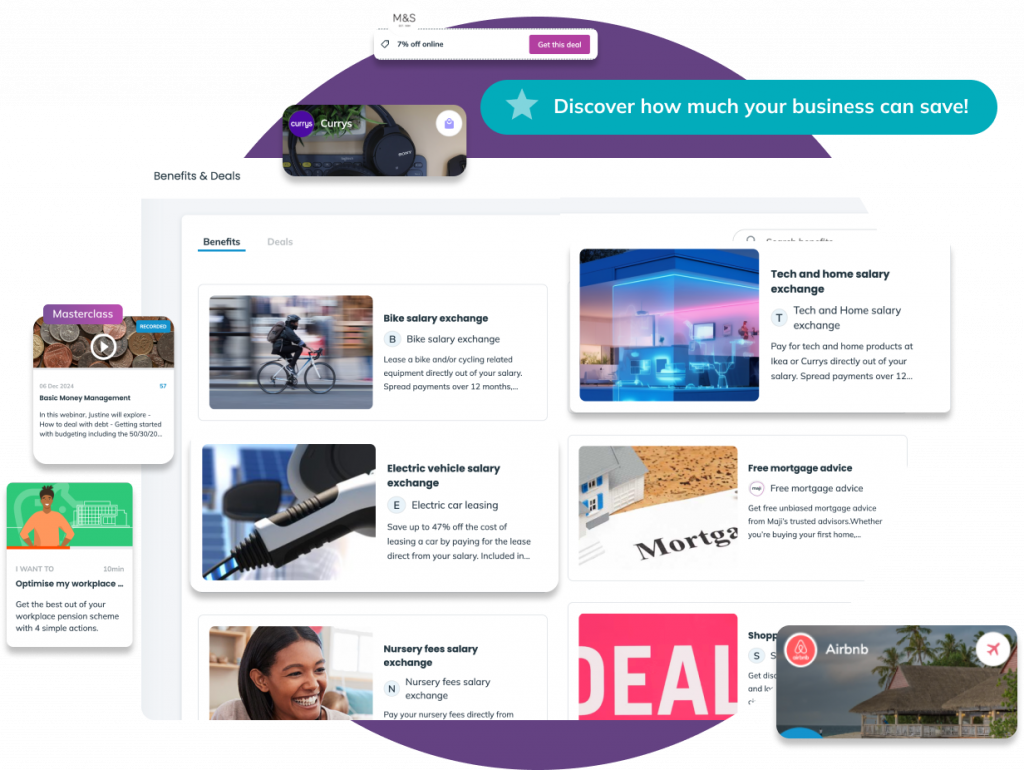

The benefits of salary sacrifice schemes

Effortless pension administration

Easily manage salary sacrifice participation with our streamlined digital platform.

Save on living costs for staff

Stand out in the market with retail deals and discounts that employees love.

Boost employee wellbeing

Reduce stress and empower your team with tools and education for financial security.

How childcare salary sacrifice works

A workplace nursery scheme is one of many salary sacrifice options for employers. It’s quick and easy to implement – and a great place to start as part of your employee benefits strategy. Here’s how it works:

Employee agreement

Employees agree to exchange part of their gross salary in return for their employer covering their nursery fees.

Tax savings

The sacrificed amount reduces taxable payroll, lowering employee NI and income tax contributions, and reducing your NI liabilities.

Money to invest

Employers can reinvest NI savings into employees’ benefits or other business priorities

Think you’re missing out on savings? We can help you determine how much you could be saving with a childcare salary sacrifice scheme.

Why Maji?

With Maji’s expertise in supporting SMEs with valuable financial wellbeing technology, this partnership delivers a solution that works for you, your employees, and your bottom line.

Seamless Setup

Our team handles everything from design to implementation with minimal disruption.

Compliance Expertise

We ensure your scheme meets all regulatory requirements and is HMRC compliant.

Tailored Solutions

Our solution is customised to fit your organisation’s needs and workforces’ varying demographics

Proven Impact

Enhance employee engagement and retention while delivering measurable savings

Calculate your savings

Use our NI savings calculator below to instantly estimate your tax savings by offering salary sacrifice benefits.

Schemes

Savings

Number of employees taking up benefit

Employees

Pension salary sacrifice

£0

Pension coaching

£0

0

Workplace nursery

£0

Electric car

£0

Cycle to work

£0

£0 a year in savings

Estimates are based on certain assumptions

Assumptions

- Assume pension contributions on full salary, with average employee contribution of 5%

- On average 40% of employees increase pension contributions from pension coaching

- UK average nursery fees of £15,600pa. On average 7% of employees have children at nursery

- Average savings per car leased are £1000 pa

- UK average spend on cycle equipment is £900

- NI rate of 15%

Contact us now for a more accurate savings calculation

Think beyond childcare benefits. Think Maji.

Financial wellbeing is complex but we’ve got a simple solution fitted for every business and employee profile.

Here’s what you can get from Maji as part of our financial wellbeing platform:

✔ Salary sacrifice schemes

Pension salary sacrifice

Childcare salary sacrifice

Cycle to work

Home and tech purchases

Electric cars

✔ Money management tools for your employees

Financial education resources

Access to our academy with on-demand learning modules. Webinars and guides to empower employees financially

Financial planning and budgeting tools

Access to our budget tracking tool to identify weak points in your spending habits. Financial planning tools for future readiness

Pension coaching that boosts savings

Access to our pension coaching programme that helps employees build a secure future and increases your NI savings by 50%

Exclusive retail deals and discounts

Exclusive deals and discount offers from leading retail brands including grocery stores like Tesco, Asda and Sainsbury’s

✔ Access to money experts

Unlimited 1-1 financial coaching sessions

Expert guidance from certified financial coaches who help shape a financial plan

Free sessions with a mortgage advisor

Expert support to help employees navigate home buying

Free sessions with a financial advisor

Access to certified financial experts to support employees with financial uncertainties

Discounts on wills

Affordable estate planning solutions and will writing services

✔ All-in-one benefits hub

Access all your benefits in one place with ease. Add, edit, or manage your benefits seamlessly, whether they’re within or outside of the Maji offering.

Got questions? Read up on the Maji blog

6 min read

How salary sacrifice can help your employees access their free childcare hours

7 min read

Childcare salary sacrifice vs tax free childcare explained

6 min read

7 things to think about when choosing a workplace nursery scheme

5 min read

Workplace nursery scheme: Everything you need to know

Think nursery savings. Think Maji.

The easiest way to get started is to book a meeting with our team who can answer any questions or map out your potential savings depending on your requirements.

From there, we’ll send you a proposal to take to your business.

Frequently Asked Questions

Any employer can offer the scheme, and any employee can take part as long as:

– Childcare is provided by OFSTED or Care Commission registered childcare providers

– Children are 0 and 5 years of age

– Employees stay above National Minimum Wage

Approximately 80-90% of nurseries are utilising this scheme.

The Government provides a range of tax exemptions to encourage employers to support employees with childcare costs.

The scheme is available to employers as part of the workplace nursery exemption,

Critically, care must be wholly or partly financed by the employer. This is achieved by:

– The employer contributing substantial funding to the childcare provision – up to 10% of the employers’ NI saving goes to the childcare provider

– Ensuring the employee acts as a representative for the employer to determine how the extra financing is allocated

With Maji, all the administration and the compliance of running this scheme is taken care of, including all contact with nurseries, distribution of payments, implementation and NMW checks for employees.

– No cap on savings for parents

– No cap on the extra funding going to nurseries

– No sign-up or termination fees

– No minimum childcare fee

– Dedicated account manager

– Fully indemnified scheme

It works alongside/with 15 or 30 free hours. For most parents, this scheme replaces tax free childcare, although they can be used alongside each other to pay for different childcare services. Tax free childcare is capped at a maximum saving of 20% of fees or £2k per year, and parents have to make payments via the government portal. The workplace nursery scheme offers uncapped savings of up to 47% of fees and money is sent directly from pay, reducing admin.

Financial wellbeing is about feeling confident and in control of your money, so you can manage day-to-day expenses, handle unexpected costs, and plan for the future. For working parents, this includes managing the rising cost of childcare. Employers can support financial wellbeing through benefits like childcare salary sacrifice schemes, which reduce taxable income and make childcare more affordable, helping families feel secure and supported both at work and at home.