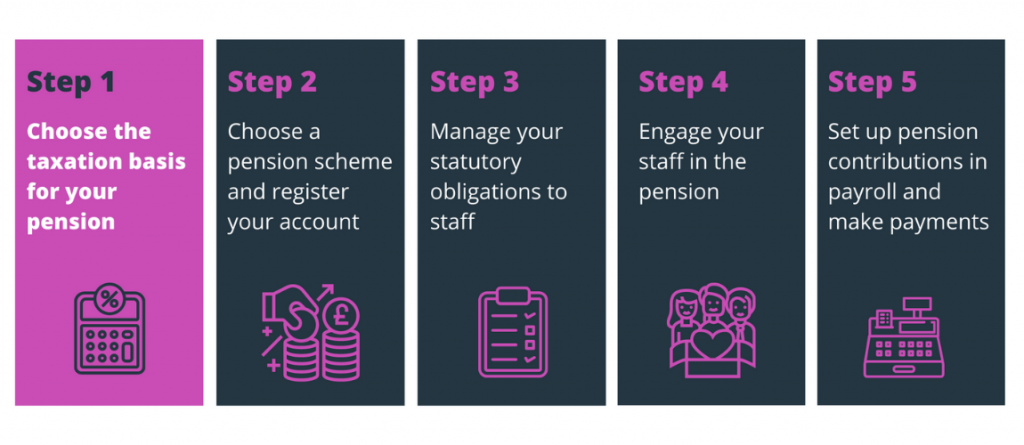

This is the first article in our series about how to set up a workplace pension scheme.

If you employ at least one person, you are considered to be an employer by the UK government. That means you have a legal duty to offer a workplace pension. However, you need to do more than just offer one. You must enroll all eligible staff and make minimum contributions on their behalf. This is called ‘automatic enrolment’ and it covers most employees, although some are exempt based on their earnings.

Table of contents

Step 1: the basics

Our Pensions 101 Series will help you make sense of your options and obligations for setting up a workplace pension. Step 1 covers the basics:

- What is a pension?

- What is auto-enrolment?

- Who must be put in a pension?

- What money goes into a pension?

- How can a pension make a difference to your business?

What is a pension?

A pension is a savings account that helps ensure a person has money to live on when they stop working (retire). Money can be paid into the pension for most of a person’s life. To encourage people to save into a pension, the government offers tax relief on payments made into it. Tax-relief means the government puts the income tax it would normally collect on the money into the pension instead. Gains from pension investments are also largely tax-free.

How are pensions funded?

Pension contributions come from three sources: the employer, the employee and the government (in the form of tax relief). Combined, they meet the minimum statutory savings amount required by law.

What is auto-enrolment?

Auto-enrolment is a government initiative to ensure people take advantage of the opportunity to save into a pension scheme. Under automatic (or auto) enrolment, employers must make all eligible jobholders members of a workplace pension scheme. That means their employer automatically enrolls them (versus them needing to opt-in). However, employees can choose to opt-out. In this case, employers need to automatically re-enrol them every three years. l

Who needs to be enrolled in a pension?

Employers assess all their employees aged between 16 and 75 to determine which are entitled to auto-enrolment. The Pensions Regulator provides more details about this process. Alternatively, your pension provider or a service like Maji can also make the assessment for you.

What money goes into a pension?

Employers are obliged to contribute a percentage of each employee’s earnings. As a statutory minimum, this must be done on their earnings between £6,240 and £50,270, also known as ‘qualifying earnings’. However, an employer can choose to base the contributions on other measurements of earnings. The Pension Regulator provides additional details.

Currently, an employer must contribute at least 3% of an employee’s salary. Employees contribute a further 5% of their own money to meet the minimum amount of 8% saved into the pension overall. However, experts recommend saving at a rate of 12-15%. Maji has planning and savings tools to help your employees get there.

How can your statutory pension duties make a difference to your business?

Offering a competitive workplace pension benefit makes your company more attractive to current and prospective employees, While salary tops the list of things employees care about, 69% say a company’s pension offering is also important. Furthermore, experts agree that taking steps to improve your team’s financial wellbeing can create a workplace culture of trust and confidence that makes employees feel valued.

Fifty-nine percent of employees say financial concerns are their biggest cause of stress. And 57% think their employer should do more to support them with their finances. It can also improve workplace productivity by reducing employees’ financial stress. Lost productivity costs UK employers £50bn a year

Help your employees save for a more financially secure future

Offering a workplace pension meets your legal obligation. Benefits-minded employers have an opportunity to go one step further with a tool like Maji to help their employees build a more financially secure future.

Maji helps you set up and manage your workplace pension. Our app also helps your employees understand the value of the pension benefit you provide. Importantly, it uses behavioral science to coach them into saving into their pension at recommended levels.

With Maji’s help you can get staff started on their financial journey early and on the right foot, By delaying pension contributions, they miss out on thousands of pounds in savings. You can also help staff prepare and feel ready for retirement. This is important considering that 37% of people say they won’t be able to retire.

About Maji

Maji is a purpose-led company tackling the UK pension savings crisis by helping people to understand the value of their pension and to save into it at recommended levels. Our financial wellbeing platform and app helps people make the most of their long-term savings options and prepare for life’s major money milestones, starting with their workplace pension. Using the latest behavioural science, Maji helps people wherever they are on their pension saving journey – whether they’re just getting started, thinking about starting, or are a long-time saver. Maji is available to users through employers and a network of trusted partners. Individual accounts will be available soon.

Get in touch to learn more about how Maji can help you unlock the hidden value of your pension for your company and your employees.

Read more in the Pensions 101 Guide for Employers series: 2, 3, 4, 5, 6